Stripe vs PayPal: Which Payment Processor Is Best for UK Businesses?

Stripe vs PayPal: Which Payment Processor Is Best for UK Businesses?

Choosing Stripe vs PayPal is one of the most important decisions a UK business can make when selling online. Your payment processor directly affects how easily customers complete checkout, how much you pay in transaction costs, and how well your website can scale as sales grow.

Although both platforms allow businesses to accept online payments securely, they are designed with very different priorities. Stripe focuses on flexibility, customisation, and long-term scalability. PayPal focuses on speed, familiarity, and reducing friction for customers who already trust the brand. Understanding how these differences affect real-world performance is essential before committing to either option.

Pricing structure and transaction costs

When comparing Stripe vs PayPal, pricing is usually the first consideration, but it is also the area where many businesses make assumptions that later prove costly.

Stripe generally follows a clear pricing structure for UK businesses, with most online card payments charged as a fixed percentage plus a fixed fee. This makes Stripe easier to forecast as a payment processor, particularly for ecommerce brands with consistent order values or subscription income.

PayPal fees are more variable. Costs can change depending on whether a customer pays using a PayPal balance, a card, an international card, or a Pay Later option. While this flexibility can be useful, it also makes PayPal fees harder to predict without closely analysing your transaction mix.

How PayPal fees impact long-term margins

PayPal fees often look reasonable at low volumes, but they can increase as a business scales. International payments, currency conversion, refunds, and certain payment features can all add incremental costs. Over time, these small differences can have a noticeable impact on profit margins.

For UK businesses operating with tight margins, understanding how PayPal fees accumulate across different payment types is essential before choosing PayPal as a primary payment processor.

Why Stripe is easier to budget for growth

Stripe’s pricing consistency makes it easier to plan ahead. Because costs are more predictable, finance teams can model future transaction volumes with greater confidence. This predictability is one of the reasons Stripe is often chosen by growing UK businesses that want fewer pricing surprises as sales increase.

Stripe vs PayPal transaction fees

When comparing Stripe vs PayPal, transaction fees play a major role in determining how much revenue a business actually keeps. Even small percentage differences can add up over time, especially for UK businesses processing a high volume of payments or selling internationally.

Stripe transaction fees (UK):

- Standard UK cards: typically 1.5% + 20p per transaction

- European (EEA) cards: usually 2.5% + 20p, reflecting cross-border processing

- International cards (outside EEA): around 3.25% + 20p

- Stripe Link (accelerated checkout): can offer lower rates for UK cards, sometimes from 1.2% + 20p, helping to reduce costs and improve checkout speed

- BACS Direct Debit: charged at 1% + 20p, with a cap applied, making it cost-effective for larger or recurring payments

Stripe’s pricing is mainly influenced by the origin of the card, which makes costs relatively predictable. For UK businesses planning growth, this predictability makes Stripe easier to budget for and model as transaction volumes increase.

PayPal transaction fees (UK):

- Standard online card payments: often up to 2.9% + 30p per transaction

- QR code payments: typically lower, starting from around 1.5% + a fixed fee for transactions over £10

- Alternative Payment Methods (APMs): fees vary by method, commonly around 1.2% + 30p, depending on how the customer pays

PayPal fees are more dependent on the payment method chosen by the customer rather than just card origin. While this flexibility can be useful, it also means costs can be harder to forecast without reviewing detailed transaction reports.

For UK businesses, the key difference is control and predictability. Stripe tends to offer clearer, more consistent pricing, while PayPal can be more variable but may deliver higher conversion rates for customers who prefer paying through their PayPal account.

Note: Fees can change over time. Always check the provider’s official UK pricing pages for the most up-to-date rates before making a final decision.

Checkout experience and conversion performance

Checkout design plays a critical role in how Stripe vs PayPal affects revenue. Even small differences in payment flow can influence whether customers complete or abandon a purchase.

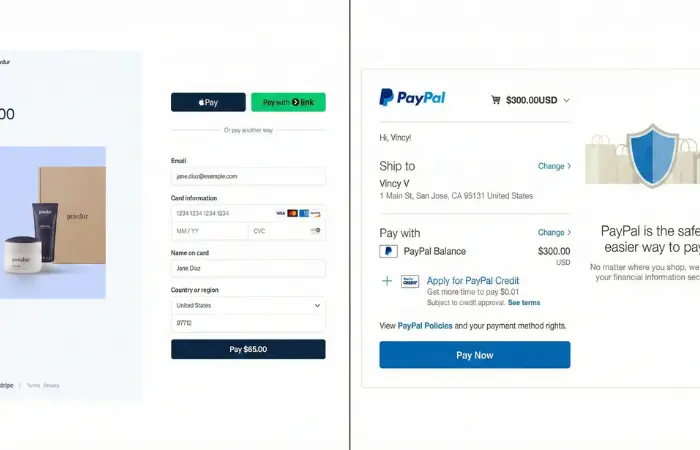

Stripe is designed to keep customers on your website during checkout. This allows businesses to fully control branding, layout, and messaging, creating a seamless experience that aligns with the rest of the site. For businesses investing in conversion rate optimisation, this level of control is a major advantage.

PayPal typically redirects customers to a PayPal-hosted checkout. While this limits branding control, it leverages PayPal’s strong reputation. Many customers feel more comfortable completing payments through PayPal, particularly when buying from a new or unfamiliar website.

Trust versus control at checkout

The core trade-off in Stripe vs PayPal checkout design is trust versus control. Stripe offers consistency and customisation, while PayPal offers instant reassurance. For established brands with strong design and UX, Stripe’s on-site checkout often converts better. For newer brands, PayPal’s familiarity can reduce hesitation and increase completed purchases.

Many UK ecommerce sites address this by offering both options, allowing customers to choose the payment method they trust most.

International payments and currency handling

For UK businesses selling internationally, the differences between Stripe vs PayPal become more pronounced. Currency support and conversion fees can significantly affect net revenue.

Stripe supports a wide range of currencies and allows customers to pay in their local currency. Funds are then settled to your UK account, with a clear currency conversion fee applied. This makes Stripe easier to manage for businesses selling across multiple regions.

PayPal operates in more countries, but supports fewer settlement currencies. PayPal fees for international transactions often include additional cross-border and foreign exchange costs, which can reduce profitability for businesses with a global customer base.

Choosing the right payment processor for international sales depends on where your customers are based and how frequently you receive non-GBP payments. In many cases, Stripe offers more predictable outcomes for UK businesses expanding overseas.

Subscriptions, scalability, and operational fit

Beyond one-off transactions, Stripe vs PayPal should be evaluated based on how well each platform supports long-term operations.

Stripe is widely used by subscription-based businesses because it supports recurring billing, plan changes, failed payment recovery, and detailed reporting. This makes Stripe a strong payment processor for SaaS companies, memberships, and service-based businesses with ongoing billing needs.

PayPal also supports recurring payments, but it is generally better suited to simpler subscription models. As billing logic becomes more complex, managing subscriptions through PayPal can require additional manual work.

Integrations and future scalability

Stripe is designed to integrate deeply with ecommerce platforms, accounting tools, and custom systems. This flexibility allows businesses to automate processes and scale without changing their payment processor later.

PayPal prioritises simplicity and speed of setup. While this makes it easy to launch quickly, it can limit how well PayPal fits into more complex workflows as a business grows.

Stripe vs PayPal: which is right for your business?

There is no single winner in the Stripe vs PayPal comparison. The right choice depends on how your business operates, who your customers are, and how you plan to grow.

Stripe is often the better payment processor for UK businesses that value checkout control, predictable pricing, subscriptions, and long-term scalability. It works particularly well when combined with a well-designed ecommerce website and strong technical foundations.

PayPal is often the better option for businesses that prioritise speed, familiarity, and customer trust. For audiences that actively prefer PayPal, higher PayPal fees can be offset by improved conversion rates.

Using Stripe and PayPal together

Many UK businesses do not treat Stripe vs PayPal as an either-or decision. Instead, they use Stripe as the primary payment processor for card and wallet payments, while offering PayPal as an additional option at checkout.

This approach gives customers choice without sacrificing control or scalability. When implemented correctly, it can increase conversions while keeping payment processor costs manageable.

Final Thoughts

Choosing between Stripe vs PayPal should be a strategic decision, not a quick one. Stripe excels in flexibility, scalability, and predictable pricing. PayPal excels in trust, familiarity, and ease of use.

For many UK businesses, the most effective solution is a carefully implemented combination of both, aligned with overall ecommerce goals. When payment processing is planned alongside ecommerce website design, payment gateway integration, and SEO strategy, it becomes a growth enabler rather than a limitation.

Not sure whether Stripe or PayPal is right for your business?